Analysis of the development of the office furniture industry

Office furniture refers to work furniture used in the office or home, including office chairs, filing cabinets and desks. Office furniture is a representative of modern commercial society, its market demand and economic development level of high correlation, Europe, the United States and Japan and other developed economies are the traditional market for office furniture.

In addition to the rapid growth of China's office furniture market in the world, the rise of emerging economies such as Brazil and India has also made a certain contribution to the development of the global office furniture market.

1. China's office furniture output ranks first in the world

According to the "Global Market Outlook for Office Furniture" report published by the Industrial Research Center (CSIL) in Milan, Italy in December 2019, after substantial growth in 2017 and 2018, global office furniture production has hardly increased in 2019, but an increase of 8% compared with 2013.

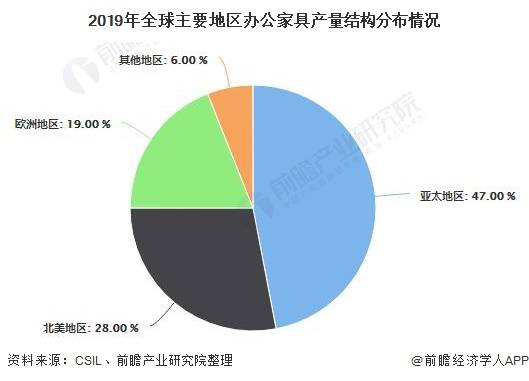

In 2019, the total output value of global office furniture reached 53 billion US dollars, accounting for about 12% of the total global furniture production. The Asia-Pacific region is the leading producer of office furniture, accounting for 47% of global office furniture production, by North America, which accounts for 28% of global office furniture production. Europe ranks third, accounting for 19% of global office furniture production. The share of production in other regions is negligible.

Office furniture production in 2019 is highly concentrated in 8 countries, accounting for about 78% of total production. Globally, China clearly dominates, and in 2010, China replaced the United States as the world's number one producer of office furniture, sliding to second place. Currently, China produces more than $16 billion, accounting for 31% of global office furniture production. Among the major office furniture producing countries, Japan, the United States and Canada are highly professional, accounting for more than 15% of office furniture production.

2. China's office furniture sales rank second in the world

In 2019, the total global office furniture consumption was about 51 billion US dollars, accounting for about 12% of the total global furniture consumption. From 2013 to 2019, the total consumption of global office furniture increased by 8%, and the entire furniture market increased by 11% during the same period.

From the perspective of consumption regions, the Asia-Pacific region is the main consumer market for global office furniture, accounting for 41% of global office furniture consumption, and its office furniture consumption has increased from $18 billion in 2013 to $21 billion in 2019. This was by North America and Europe, which accounted for 32% and 20% of global consumption, respectively. Office furniture consumption in the North American market grew rapidly, with office furniture consumption in Asia growing by 22% in 2013-2019, while other regions experienced negative growth.

From the perspective of consumer countries, about 80% of global office furniture consumption occurs in the United States, China, Japan, Germany, India, Canada, Brazil, France, the United Kingdom and Australia. Among them, the United States has a huge economic volume and a developed business environment, is the world's largest consumer of office furniture, in 2019, the United States office furniture consumption accounted for about 29% of global consumption, the consumer market size of about 14.9 billion US dollars.

According to the per capita consumption of office furniture in the 60 countries selected by CSIL, the regions with the highest per capita consumption levels were North America and Western Europe, while South America, Eastern Europe and Asia had the lowest per capita consumption.

3. China is a major exporter of global office furniture

Global office furniture trade was $7.6 billion in 2010 and $10.9 billion in 2019. According to CSIL's forecast, global trade will grow by 2% and 3% in 2020 and 2021, respectively.

The United States is the largest importer of office furniture, with imports of office furniture exceeding $2.7 billion. The largest importer of office furniture in the United States is China, by Canada, Mexico, Taiwan and Germany. In the total imports of U.S. office furniture, China's share is declining due to Sino-US trade tensions.

The main exporters of office furniture are China, Canada, Germany, the United States and Italy. China's export share of office furniture increased from 30% in 2010 to 38% in 2019.